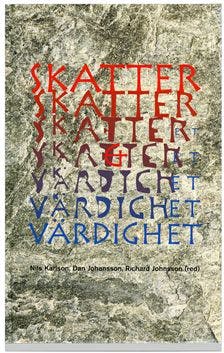

Skatter och värdighet

Abstract

Vilka är skatternas allvarligaste effekter? Är dagens skattenivå rimlig i ett ekonomiskt och normativt perspektiv? Om inte, vad bör i så fall göras åt saken? Dessa frågor utgör utgångspunkten för den tvärvetenskapliga antologin Skatter och värdighet.

Den ena huvudtesen är att skatterna motverkar arbetsdelning och sysselsättning. Annorlunda uttryckt gör skatterna att vi jobbar osmart. Allt fler av oss sysslar med fel saker. Dessutom utestängs väldigt många i arbetsför ålder från arbetsmarknaden.

Den andra huvudtesen är att skatternas konsekvenser utgör ett hot mot människors värdighet. Att kunna försörja sig själv och sina närmaste är en central del i ett värdigt liv. När skatter minskar förutsättningarna för sysselsättning, företagande, sparande och tillväxt undergrävs den enskildes värdighet.

I Skatter och värdighet analyseras skatters normativa legitimitet, skatternas och den offentliga sektorns historiska utveckling, skatternas effekter på den enskildes komparativa fördelar, effektivitetsproblem med höga skatter, skattekilar på hushållsnära tjänster samt förmögenhets-skattens konsekvenser.

Dessutom presenteras ett antal konkreta förslag på hur förutsättningarna för arbete, företagande och värdighet snabbt och enkelt skulle kunna förbättras genom rejält sänkta skatter. Effekterna är dramatiskt positiva.

Karlson, N., Johansson, D. & Johnsson, R. (Eds.) (2004). Skatter och värdighet. Stockholm: Ratio.

Följande forskare medverkar:

Åsa Hansson

Dan Johansson

Richard Johnsson

Nils Karlson

Erik Moberg

Lars Niklasson

Anne-Marie Pålsson och

Gunnar Du Rietz.

Redaktörer: Docent Nils Karlson, vd för Ratio. Fil dr Dan Johansson, forskare vid Ratio. Fil dr Richard Johnsson, forskare vid Ratio.

Details

- Author

- Karlson, N., Johansson, D. & Johnsson, R.

- Publication year

- 2004

- Published in